Most lenders will refuse to approve a cash-out refinance on any residence with below twelve months of seasoning. That is to stop prospective buyers from flipping and/or serially refinancing Homes.

Neighborhood political failure: Regional public health officers unsuccessful the place with a few like Dr Oxiris Barbot encouraging folks to take the Ny city subway at the same time as COVID-19 was spreading like wildfire working with circular rationale that the subway has to be Harmless simply because not many people are Ill nonetheless.

With their flexible eligibility guidelines an FHA cash-out refinance might be a sensible choice for some homeowners, They're undoubtedly not the one possibility.

Home equity loan: A house equity loan permits you to borrow versus the equity in your home with out refinancing. You receive a lump sum of cash which you’ll pay back with regular monthly installments to the principal and fascination until the loan is paid out in full

The funds you get by way of a cash-out refinance are certainly not regarded as income, and so are usually not subject to taxation. In essence, you're simply taking out a brand new loan (which you'll, not surprisingly, be needed to repay with curiosity) so there will be no income tax to pay.

It's because lenders usually established greater minimums compared to FHA. If one lender can’t make your loan, retain searching until you find just one with much more lenient criteria.

The amount of am i able to save which has a debt administration strategy for my bank cards? four basic measures to have the respond to

The equity you've built up in your house or investment property is a really serious asset that may be tapped to deliver access to Prepared cash when you will need it. Even so, Like several monetary venture, borrowing towards that equity comes along with certain hazards, Main among the them a long term house loan as well as the probable forfeiture of your collateral (ie your home). Whilst cash-out refinancing does supply speedy access to cash, it is necessary to weigh each of the positives and negatives in advance of opting for a new loan.

Lenders will request work documentation or utility bills to verify you’ve occupied the house as your Major residence for your past year.

Among the most significant dissimilarities would be the paperwork and underwriting system. The Streamline Refinance typically will involve a lot less documentation and fewer ways.

If you just take out a loan, it's essential to pay back again the loan additionally desire by producing regular payments on the bank. To help you imagine a loan being an annuity you spend to the lending institution.

This consists of talking to more than one lender and finding estimates from a number of different places. Car dealers, like numerous businesses, intend to make just as much cash as possible from a sale, but generally, provided enough negotiation, are willing to market a car for drastically less than the price they at first offer you. Obtaining a preapproval for an automobile loan by way of direct lending can aid negotiations.

Builders CAPLine: delivers funding to smaller basic contractors to assemble or rehabilitate household or industrial residence for resale. This system provides an exception beneath specified conditions to the general rule from funding investment home.

Borrowing from the Life Insurance plan – If you need to access some Completely ready cash within an emergency you may choose to borrow towards your life coverage, assuming you might be holding a ‘whole life' or ‘long term lifestyle' policy. Should you have built up sufficient cash price inside the coverage, most insurance policies firms will let you tap into that click here amount. This can be a viable alternative if you discover it tricky to qualify for a traditional loan, or the premiums and conditions you are now being made available are too draconian.

Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Shannon Elizabeth Then & Now!

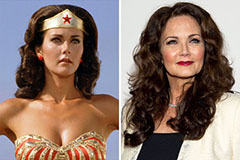

Shannon Elizabeth Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!